Quick links

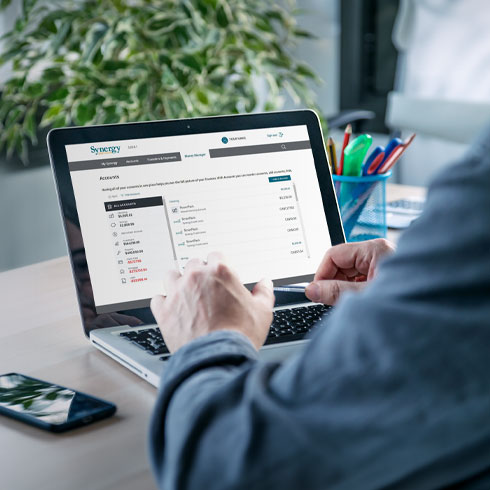

Get the full scoop on your cash flow!

With Money Manager, you can hook up all your accounts, even ones from different places, to see everything in one spot. Easy peasy! Our tools, like budgeting and tracking spending, along with handy demo vids, make handling your money a cinch.

Ready to make your dream of owning a home a reality?

Get started with the First Home Savings Account (FHSA)! Save up to $8,000 a year tax-free!

What can we help you with today?

Join a financial institution where you're treated like a VIP, regardless of your balance.

Open an account with Synergy CU online in just 10 minutes – it's quick, easy, and hassle-free!

Promotions and Special Offers

Be in the loop about our latest promotions and special offers that can give your finances a boost. Explore this section to find out how Synergy Credit Union is committed to helping you save and succeed.

SYNERGY SHARES WITH STUDENTS

We're offering TWO no-essay scholarships, each worth up to $4,000.*

*Conditions apply.

FINANCIAL GOALS DESERVE RECOGNITION

Speak* with a Synergy Credit Union financial expert between September 12, 2023, and April 30, 2024, and qualify to win one of three (3) $1000 prizes plus a $5000 travel voucher grand prize!

*Terms and conditions apply.

YOUR NEXT VACATION COULD BE MORE THAN ITS OWN REWARD

You could win up to $5,000 just by using your Mastercard® when you travel*.

*See terms and conditions for full details.

Check out our other credit card promotions and offers.

SYNERGY SHARES WITH STUDENTS

We're offering TWO no-essay scholarships, each worth up to $4,000.*

*Conditions apply.

FINANCIAL GOALS DESERVE RECOGNITION

Speak* with a Synergy Credit Union financial expert between September 12, 2023, and April 30, 2024, and qualify to win one of three (3) $1000 prizes plus a $5000 travel voucher grand prize!

*Terms and conditions apply.

YOUR NEXT VACATION COULD BE MORE THAN ITS OWN REWARD

You could win up to $5,000 just by using your Mastercard® when you travel*.

*See terms and conditions for full details.

Check out our other credit card promotions and offers.

Empowering Through Education

Discover valuable resources to enhance your financial knowledge, from engaging presentations to self-paced online courses and a treasure trove of tips and articles in our Advice Centre.

Protect yourself from scams!

Fraud can hit anyone, anytime, anywhere in Canada – be it through calls, mail, or online schemes. Stay ahead of the game with a simple mantra: ‘Stop, Look, Think, and Verify’ before you act. It’s your best bet for keeping fraudsters at bay.

Get savvy with your money!

Dive into our resources tailored to help you master financial smarts. It's all about steering you towards financial wellness, one step at a time.

Get ready to level up your money game!

Say hello to the 'It's a Money Thing Academy' brought to you by Synergy Credit Union. It's not just banking; it's about boosting you and your community. Dive into our free online courses tailored to help you ace your finances.

Let's Get Social

Check out the great things we are doing to help our members and the communities we serve. And, while you're there, why not join us on social?

Reach Out to Us

If you have any questions, don't hesitate to reach out to us by phone or in person.

Book an Appointment

Schedule an appointment effortlessly by booking a meeting with a Synergy expert at your convenience through our online booking system.

Visit us

Visit us

Visit any of our branches in Denzil, Kindersley, Lashburn, Lloydminster, Macklin, Maidstone, Marsden, Marshall, Neilburg, Paradise Hill, Saskatoon, and St. Walburg. We look forward to welcoming you!

Give us a call

Give us a call

Reach out to our local experts at the Member Contact Centre for assistance by calling 1-306-825-3301 (local) or 1-866-825-3301 (toll-free) during the following hours:

- Mon to Fri: 8 a.m. to 8 p.m. MT

- Sat & Sun: 9 a.m. to 5 p.m. MT

- Stat Holidays*: 9 a.m. to 3 p.m. MT

Search

Search

JOIN US

JOIN US