Personal Mortgage Rates

Compare today’s mortgage rates and find the option that aligns with your homeownership goals. Quickly explore the rates below to see what fits your budget and future plans.

| Simplicity Mortgage | Rate* (Insured) | Rate* (Conventional) |

| Variable (Prime - 0.50%) | 3.95% | 3.95% |

| Fixed (1-Year) | 4.99% | 5.19% |

| Fixed (2-Year) | 4.59% | 4.64% |

| Fixed (3-Year) | 4.04% | 4.39% |

| Fixed (4-Year) | 4.09% | 4.44% |

| Fixed (5-Year) |

4.09% | 4.44% |

| Open Mortgage | Rate* |

| Variable (Prime + 2.00%) | 6.45% |

| Fixed (1-Year) |

7.59%

|

| Super Mortgage | Rate* |

| Variable (Prime + 0.50%) | 4.95% |

| Fixed (1-Year) | 5.69% |

| Fixed (2-Year) | 5.14% |

| Fixed (3-Year) | 4.89% |

| Fixed (4-Year) | 4.94% |

| Fixed (5-Year) | 4.94% |

| Personal Construction Mortgage | Rate* |

| Variable (Prime + 2.00% - interest only) | 6.45% |

*Rates are provisional and subject to approved credit. Mortgages are compounded semi‑annually, not in advance. Rates may change without notice.

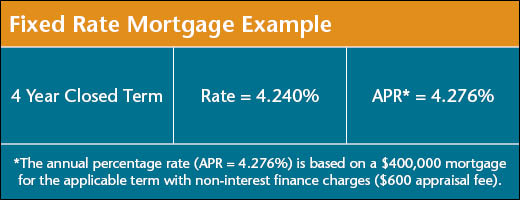

Understanding APR

- The Annual Percentage Rate (APR) reflects the total cost of borrowing, including the interest rate and any required fees.

- If there are no additional cost‑of‑borrowing charges (such as appraisal fees), the APR will match the posted rate (AIR).

- Applicable to residential mortgages that meet Credit Union lending criteria. Some conditions apply.

Which mortgage fits your homeownership journey?

Explore mortgage options designed for different stages, goals, and budgets.

Simplicity Insured Mortgage

Simplicity Insured Mortgage

Simplicity Insured Mortgage

Simplicity Insured MortgageBest for first‑time buyers with <20% down.

Simplicity Mortgage

Simplicity Mortgage

Simplicity Mortgage

Simplicity MortgageDesigned for buyers with 20% or more down, offering our lowest rates and added flexibility.

Personal Super Mortgage

Personal Super Mortgage

Personal Super Mortgage

Personal Super MortgageAccess extra funds at mortgage rates for non-mortgage needs—flexible and convenient.

Variable Rate Convertible Mortgage

Variable Rate Convertible Mortgage

Variable Rate Convertible Mortgage

Variable Rate Convertible MortgageStable payments now with the option to lock into a fixed rate later.

Personal Open Mortgage

Personal Open Mortgage

Personal Open Mortgage

Personal Open MortgagePrepay anytime with no penalties for maximum flexibility.

Personal Construction Mortgage

Personal Construction Mortgage

Personal Construction Mortgage

Personal Construction MortgageBuild in stages with interest‑only payments during construction.

Ready to move forward with confidence?

Whether you’re ready to apply or want expert guidance, we’re here to support your next step.

Current offers for homebuyers

Make your move a little easier with up to $2,500 cashback* on your new mortgage.

See how the program works and what you could qualify for.

*Terms and conditions apply.

Search

Search

JOIN US

JOIN US